17 Aug Current Challenges & Future Aspects of Autonomous Bus Industry

While self-driving technology is still in its developmental stages, the autonomous market has seen a rise in the presence of manufacturers. The surging popularity of automation has paved the way for technological advancements. Burgeoning government and consumer interest have also proved lucrative for product penetration.

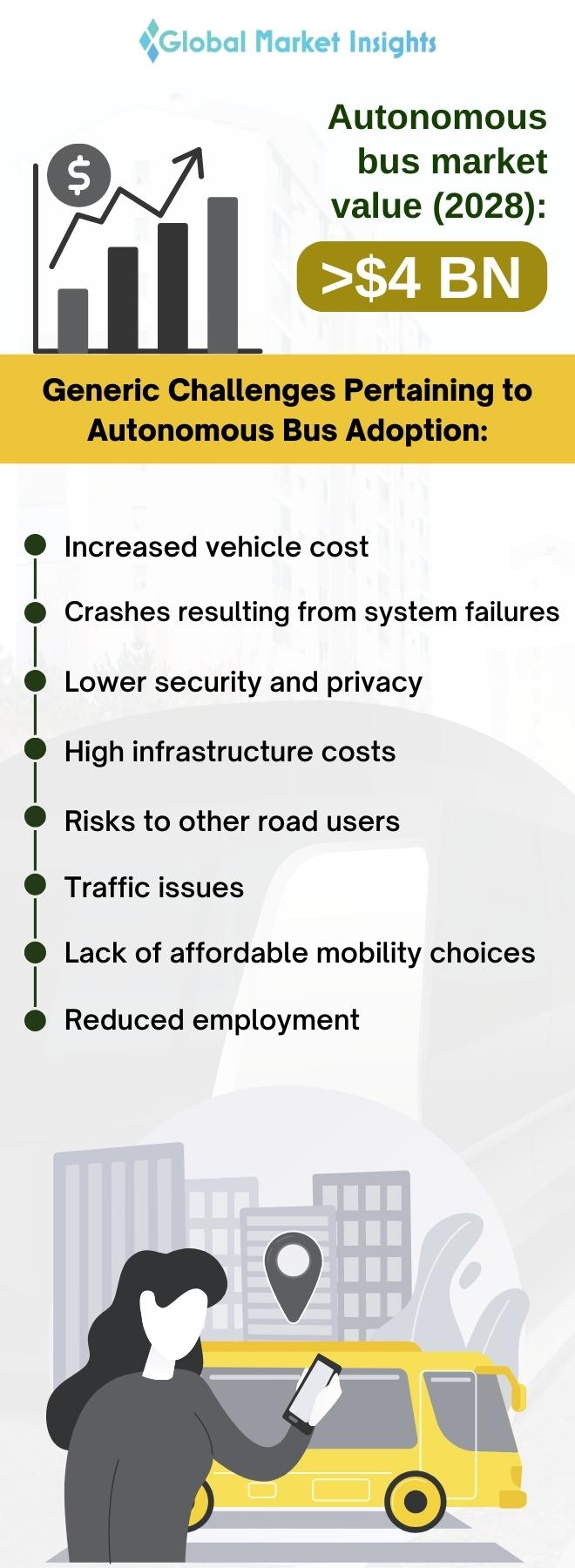

In recent years, industry leaders have been leveraging several trends to get ahead in the market. For example, with rising climate consciousness, companies such as Daimler and Volkswagen have been investing in the electrification of their fleet to meet pertinent consumer demands. Driven by these factors, the autonomous bus market is slated to be valued at more than $4 billion by the end of 2028, according to a research report by Global Market Insights Inc.

Generic Challenges Pertaining to Autonomous Bus Adoption:

Increased vehicle cost, since autonomous vehicles require additional equipment, fees, and services.

Crashes resulting from system failures, higher traffic speeds, platooning, increased overall vehicle travel, and additional risks.

Lower security and privacy due to higher chances of hacking aided by features like location tracking and data sharing.

High infrastructure costs owing to the need for extensive roadway design and maintenance standards.

Risks to other road users and potential scope of criminal activities.

Traffic issues caused by increased vehicle travel could boost pollution, congestion, and sprawl-related expenses.

Lack of affordable mobility choices, such as bicycling, walking, and transit services.

Reduced employment caused by the decline in jobs for drivers.

While these factors are slightly hampering the progression of autonomous bus industry, the various benefits offered by this technology are creating a profitable landscape for the product uptake. Furthermore, soaring emphasis on sustainability and the need to reduce dependence on fossil fuels is fostering the self-driving electric bus market outlook.

Why Autonomous Bus Market May Gain Traction Despite Existing Challenges

Widespread electrification of buses is a challenging task, however, it also presents a crucial opportunity not just for addressing the greenhouse gas (GHG) emission issue and pollution but also for reimagining a more efficient and technologically enhanced form of transport. Smarter cities, less noise, and cleaner air are some benefits electric buses promise that would be enough justification for making the switch, but they also come with several other advantages over conventional buses.

First and foremost, electricity costs significantly lesser than fossil fuels and is far less prone to price volatility and global instability. The existing smart charging networks and advanced power management tools can also promote additional savings.

Electric fueling can connect easily with other systems viz., route planning tools & telematics. This allows fleet managers to optimize the time of fueling and energy usage to further decrease costs. These advantages of electrification are shaping the future of electric buses.

Now that electrification of transport is underway, buses are seen to be the quickest, easiest, and cheapest approach to augment public transport. While this change is slow, it is a certainty. Bus fleets are integrating zero-emission vehicles. Additionally, the present fueling technologies might help unlock these benefits adequately.

Public and Private Sector Entities Penetrate Autonomous Bus Market to Bring About a Change

Building a solid standing is a key focus of industry leaders in the autonomous vehicles business. Some major manufacturers that have established a robust presence in the global autonomous bus market include AB Volvo, Scania AB, Volkswagen AG, Navya SAS, Continental AG, Tesla, EasyMile SAS, Toyota Motor Corporation, Robert Bosch GmbH, Daimler AG, and Hyundai Motor Company.

The presence of ample growth opportunities in the autonomous bus industry has helped increase the foray of other organizations into the sector as well. Recently, in April 2022, the newest addition to Michigan State University’s smart mobility ecosystem, an all-electric autonomous bus, started accepting passengers. The bus, one of the largest deployments of its kind on U.S. roads, became a novel mode of transportation for faculty, staff, students, and visitors on campus. The project was a result of a joint effort between bus manufacturer Karsan, the state of Michigan, and software company ADASTEC, which specializes in SAE level-4 automated driving for commercial vehicles.

In yet another instance, over a month ago, UK’s ‘first full-sized autonomous bus’ debuted in Scotland as a part of the live testing program pertaining to project CAVForth. The on-road testing of the autonomous bus was planned to take place sans passengers for the official launch of the CAVForth pilot service later in the year. Project CAVForth, partly funded by the Centre for Connected and Autonomous Vehicles (CCAV), will be delivered in collaboration with Innovate UK.

These are just a couple of instances of autonomous bus adoption in different regions. Consequently, the soaring number of manufacturers in the industry will impact the overall autonomous bus industry landscape in a positive manner.

Final Thoughts

While electric buses offer various benefits, there are some factors that are hindering their uptake. They require massive amounts of electricity and huge investments in charging infrastructure to supply the said electricity. Numerous government initiatives exist, certainly, to ensure that power grids can cater to the high electricity demand. In addition, however, local governments and cities need to pump capital into technologies that can support sustainable transport.

Large bus operators also need government backing by way of subsidies to invest sufficiently in the manufacturing of electric buses. To realize total electrification of public transport, cooperation between fleet operators, citizens, and government bodies, would be pivotal as well.

Self-driving and electric vehicles are at the forefront of the novel mobility model, NETRA (New Era of Transportation). Since mobility is a strategic matter for any region, this model, along with technological innovation, will result in an economic revolution. The economic impact of driverless cars can be seen across varied sectors in any country.

For instance, in June 2022, Seoul, the capital of South Korea, initiated a pilot project to install wireless charging equipment for autonomous electric city buses. These buses are embedded with wireless charging receivers and can be charged with wireless charging transmitters on roads or at bus stops.

Similar efforts across numerous regions to strengthen the infrastructure surrounding self-driving vehicles are complementing the future growth of the autonomous bus market.